Maximum Ss Withholding 2025. The social security tax rate. Given these factors, the maximum amount an.

But beyond that point, you’ll have $1 in. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, It's possible to get more than $58,000 per year from social security, but it isn't very common. The maximum wage subject to social security tax has gone up.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Limit For Maximum Social Security Tax 2025 Financial Samurai, In 2025, this limit rises to $168,600, up from the 2025 limit of $160,200. How much could you owe in social security tax?

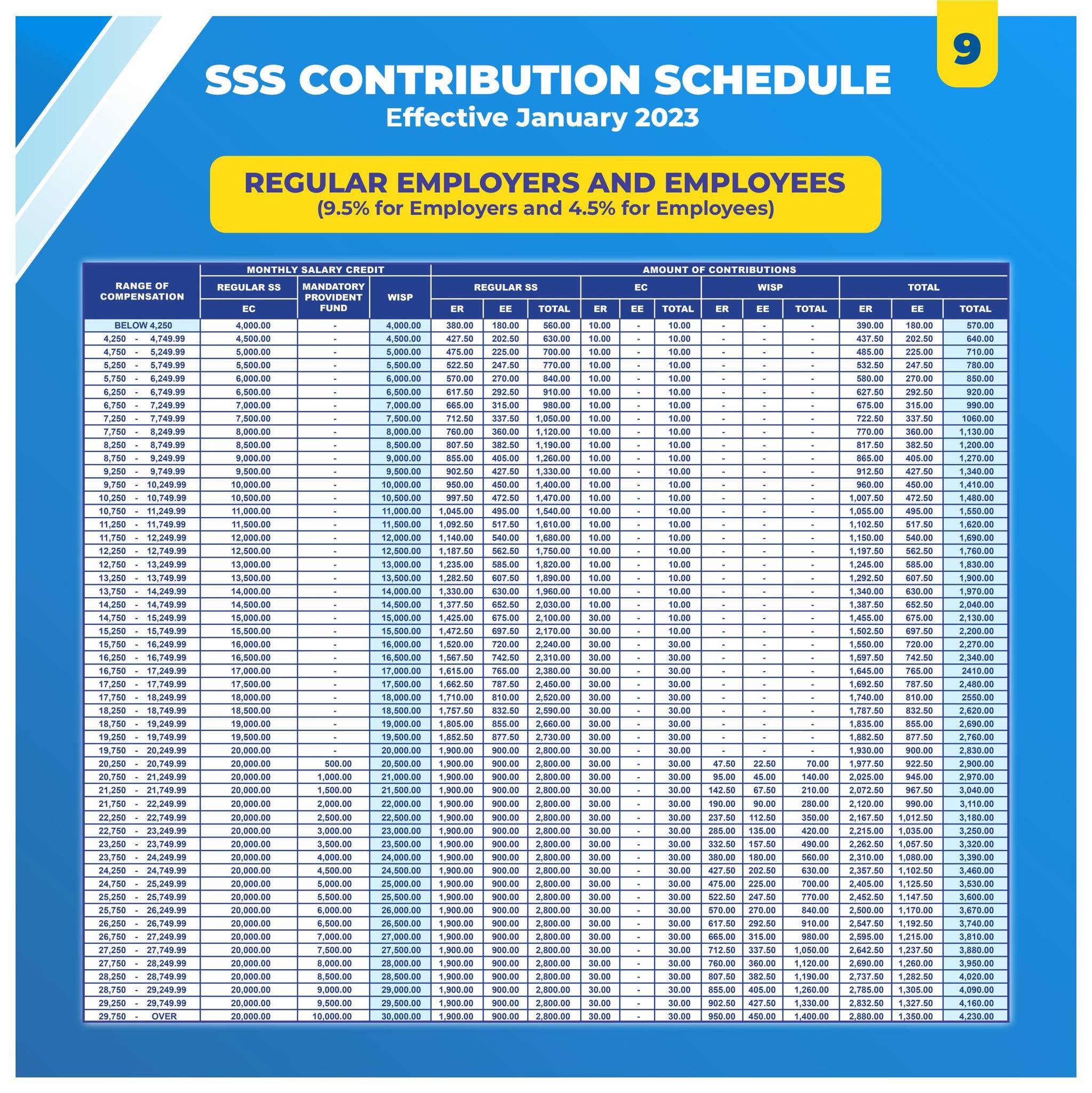

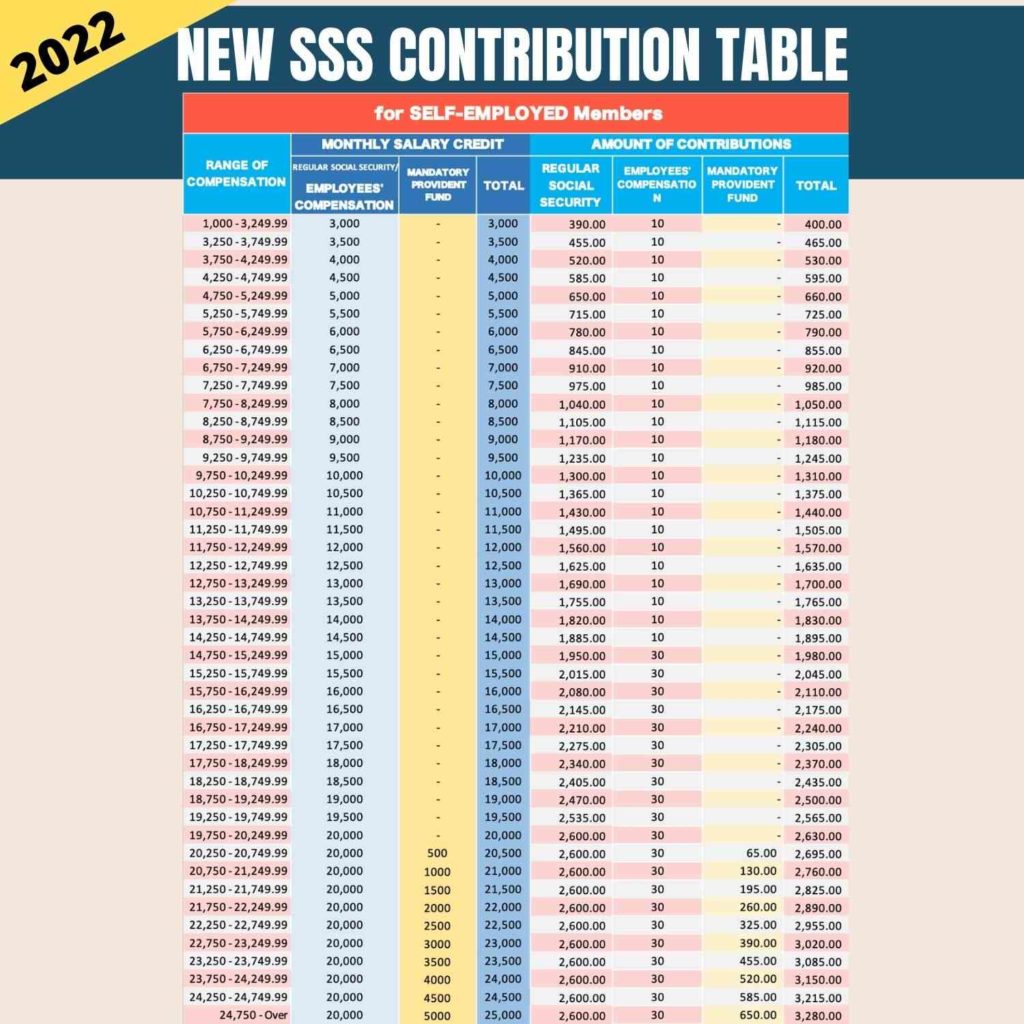

New SSS Contribution Table 2025 Schedule Effective January, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, What is the maximum possible social security benefit in 2025? This is up from $9,932.40.

When Is Medicare Disability Taxable, What is the maximum possible social security benefit in 2025? For earnings in 2025, this base is $168,600.

Maximum Social Security Benefit 2025 Calculation, 11 rows when you have more than one job in a year, each of your employers must withhold. What is the social security limit?

How To Calculate, Find Social Security Tax Withholding Social, What is the maximum social security benefit available? This amount is also commonly referred to as the taxable maximum.

How Is Social Medicare Tax Withholding Calculator, The year an individual reaches full $56,520/yr. As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security taxes.

How To Calculate Medicare And Social Security Withholding, Apply for part d extra help. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

New SSS Contribution Table 2025, Workers earning less than this limit pay a 6.2% tax on their earnings. But in 2025, they'll pay taxes on up to.

Ga Al Game 2025. The two met earlier this month in the 2025 sec championship, with nick saban’s crimson tide getting the better of kirby […]

Worst Used Cars To Buy 2025. News & world report, we’ve identified some of the best and worst used cars available. Power survey and the […]

Ohtani Pitch Schedule 2025. 22 with a 12:10 pm pst match against the padres. How valuable could he really be? Here’s what you should circle […]